FUNDS

CoRe Capital develops capital funds with investment policies focused on the productive application of capital that promotes growth processes, international expansion, and the consolidation of the Portuguese business fabric

OUR

STRATEGY

Consistency

CoRe funds invest in industrial SMEs based in Portugal, focusing on the export competitiveness of their production in strategic and growth sectors.

CoRe funds invest in the national industry, in strategic sectors such as renewable energy, health, agro-industry, wood, logistics, and metalworking. CoRe Capital subsidiaries have more than 1000 employees and more than 100 million sales (€). CoRe Restart I fund is an example of the CoRe methodology, having been considered a top-quartile TVPI by Cambridge Associates, in a benchmark of European private equity and vintage buy-out funds of 2019.

Direct investment and

co-investments

Sales growth of our subsidiaries

Jobs impacted by CoRe

Core Restart I Fund

CoRe Consolida Fund

The CoRe Consolida Fund, registered with the CMVM in 2022, invests capital in strengthening national SMEs and Mid-Caps with growth and innovation potential, seeking opportunities for sectorial integration and consolidation, contributing to the defragmentation of the Portuguese SMEs preferably in the industrial, agro-industrial, retail, tourism, transport and logistics sectors framed in the best international ESG practices.

Our

investors

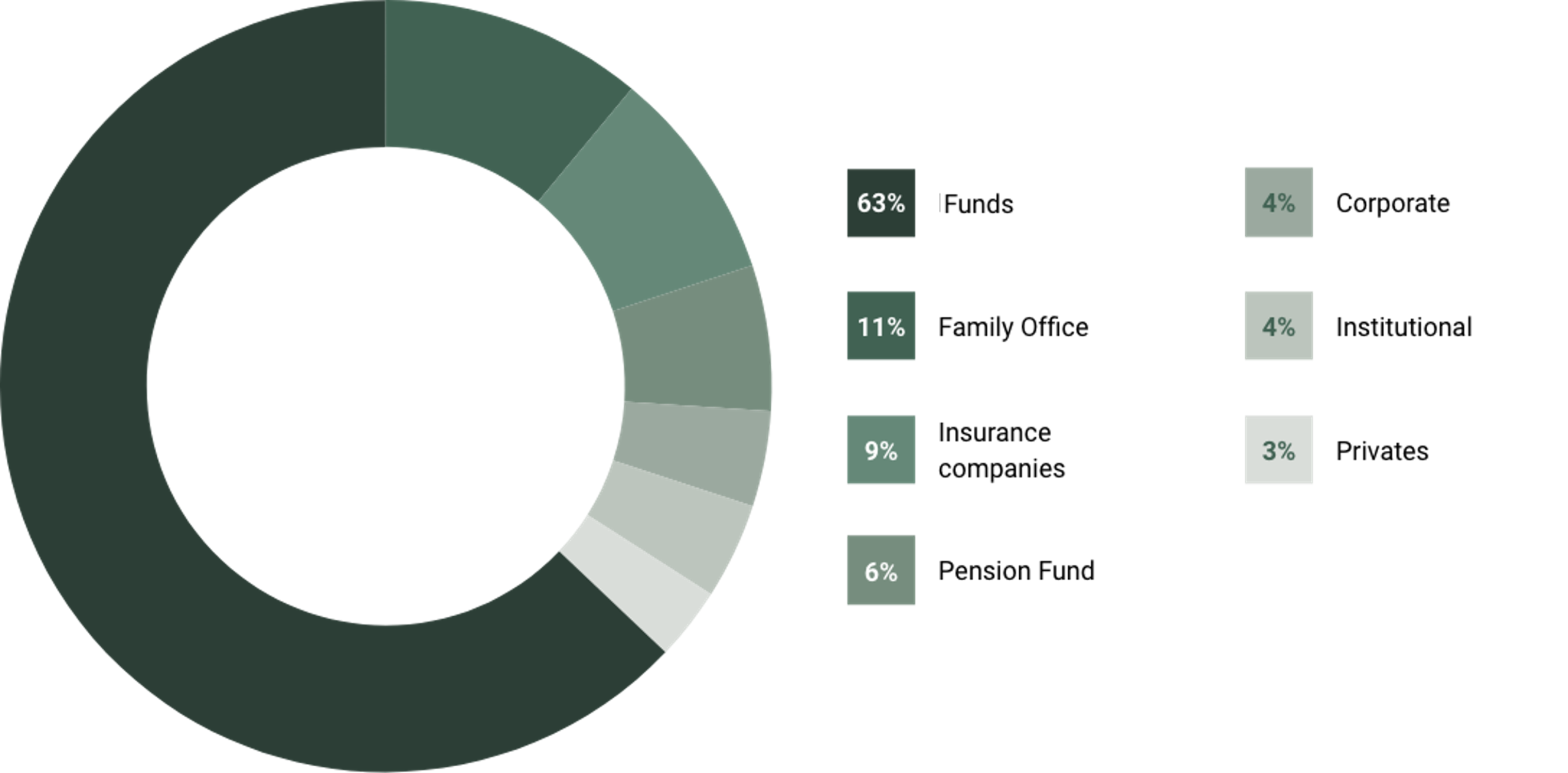

The Investors in the Funds managed by CoRe Capital are entities specialized in investing in collective investment undertakings, namely Family Offices, Insurance Companies, and Funds.

Investors

We believe in Portuguese entrepreneurs' accumulated knowledge, and we want to grow with them by investing fresh money in the ambition of our SMEs and bringing modern management to consolidate fragmented sectors. Together, we are worth more.

Alternative Dispute Resolution (ADR)

CoRe Capital is a signatory of the ADR Protocol executed with the Portuguese Securities Market Commission, having joined the consumer arbitration network composed of the following entities:

- Consumer Conflict Arbitration Centre of the Coimbra Region (CACRC);

- Consumer Conflict Arbitration Centre of the Coimbra Region (CACRC);

- Consumer Conflict Arbitration Centre of Ave, Tâmega and Sousa (TRIAVE);

- Porto Consumer Information and Arbitration Centre (CICAP);

- Consumer Information, Mediation and Arbitration Centre (Consumer Arbitration Court) (CIAB);

- Algarve Consumer Information, Mediation and Arbitration Centre (CIMAAL);

- National Consumer Conflict Information and Arbitration Centre (CNIACC);

Non-professional investors may resort to these arbitration centres to resolve potential disputes with CoRe Capital, involving amounts not exceeding €30,000, related to investments in risk capital funds managed by CoRe Capital.